Focus Areas

Education Financing

Education financing is the social and political process through which public revenue and other resources are collected and used to fund education and lifelong learning.

Why is education financing an issue?

Education financing gap: An annual financing gap of US$97 billion exists for low and lower-middle income countries to meet SDG4 by 2030. Additionally, 97% of education funding originates from domestic sources, yet funding focus remains on external aid, ignoring more viable options like sustainable public financing from progressive tax systems and debt relief.

Debt servicing: Over three quarters of all lower-income countries spend more on debt servicing than education.

Austerity measures: Especially in a post-COVID-19 context, global austerity measures have led to cuts in education spending at the national level exacerbating the education crisis, increasing precarity for teachers and students alike, while also blocking the hiring of more teachers despite shortages.

Tax justice: When governments lose an estimated US$492 billion annually to tax abuse and evasion, they forfeit crucial resources needed to invest in the right to education, undermining progress toward free, quality, and inclusive public education for all.

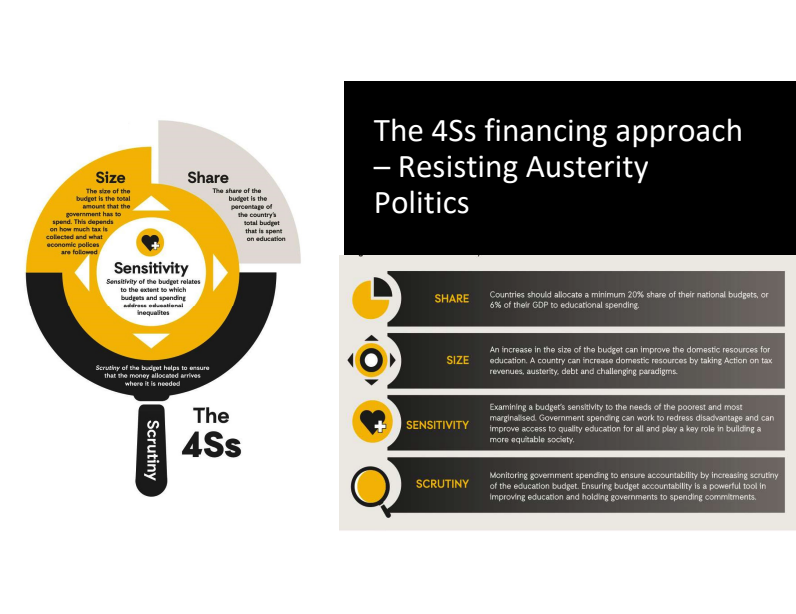

The 4S Framework

The 4S framework for education financing focuses on how governments can increase sustainable, progressive and gender-responsive domestic financing for public education. The framework outlines four key areas:

increasing the share of the education budget to meet the globally recommended minimum of at least 20% of the national budget or 6% of GDP);

increasing the size of the national budget through concerted action on tax justice, debt justice and reversing austerity;

improving budget sensitivity to address inequalities in education; and

enhancing accountability and scrutiny of the education budget.

Image from Transforming Education Financing Toolkit

This updated toolkit, at the midpoint of the SDGs sets out a bolder vision for financing education, influenced by recent agreements at the UN Transforming Education Summit, rooted in ensuring financing can support the delivery of the right to education.

Cross-Country Analysis

This report investigates how progressive tax policy reforms can transform the financing of public education systems. It specifically focuses on how recovering revenue lost to tax abuse and implementing wealth taxes can strengthen education systems by generating more resources to invest in teachers, infrastructure and school programmes.